https://www.fcd-us.org/2012-child-well-being-index-cwi/

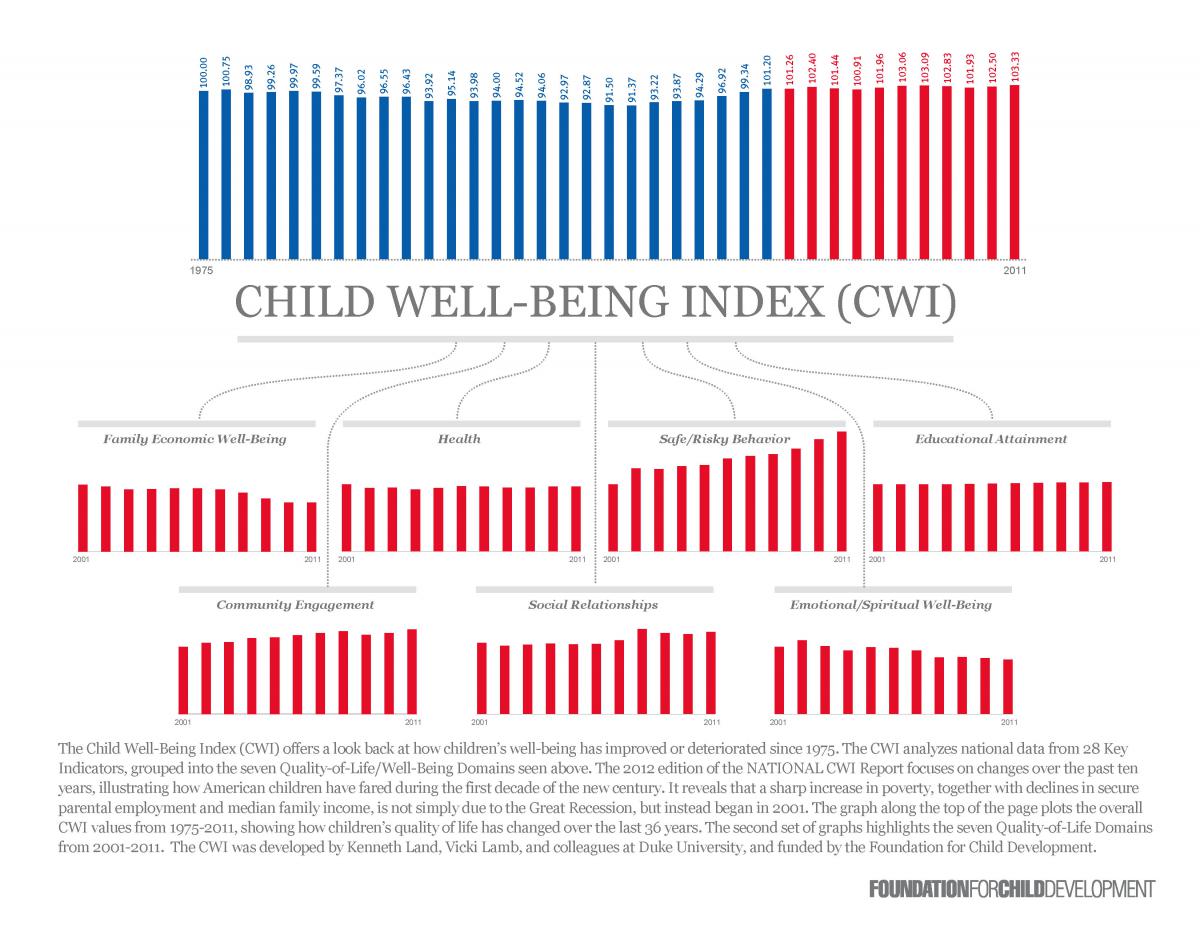

The 2012 Annual Release of the CWI reports that American families’ economic decline preceded the recession, jeopardizing both middle class and low income children.

American families endured a decade of economic decline from 2001-2011 that left a larger share of the nation’s children in poverty than was the case in 1975. The report also finds a large increase in poverty, together with declines in secure parental employment and median family income that are not simply due to the current recession, but instead can be traced back to 2001.

Other key findings of the report include:

- Poverty is up. Over the past decade, the percentage of children living in families below the poverty line has increased from 15.6 percent in 2001 to 21.4 percent in 2011.

- Median family income is down: Families with children ages 0 – 18 have sustained a large decline in median family income, from $62,796 in 2001 to $55,918 in 2011 — a drop of $6,300 (in real dollars).

- Secure employment is down: Parents today are less likely to be securely employed than they were in 2001.

- PreK enrollment progress has stalled. Despite solid improvement in the 1990s, we have failed to sustain a pattern of growth in PreK enrollment in this past decade.

- Educational Attainment progress is slow. In the year 2000 (the most recent year prior to 2001 for which data are available), only 29 percent of children in the 4th grade were reading at grade level.

- Health insurance coverage has increased only slightly. We have consistently been unable to provide health insurance to nearly 1 in 10 children.

Recommendations

The Foundation for Child Development urges policymakers to take action to protect the basic economic, educational, health, and nutritional supports we now provide for children.

The Foundation recommends that policymakers:

- Protect children from cuts in programs and tax benefits that affect their economic security, including the Child Tax Credit, the Earned Income Tax Credit, and notably their refundability provisions. These must not be on the bargaining table.

- Make substantial, reliable, and sustained investments in effective early education programs that have real potential to improve the reading, math, and social skills of our young children, such as PreK to 3rd programs.

- Continue to expand health care coverage, and ensure that the provisions under the Affordable Care Act (ACA) are implemented to include every child.

For media inquiries please contact Mark Bogosian at 212-867-5777x217.